Welcome to the November 2017 edition of the lithium miner news. Due to the massive growth in the lithium sector and the number of lithium miners we are tracking we have decided to split the monthly news into two. The new additional monthly news will be focused on the "junior" lithium miners, and will be published a few days after this one each month. For now we have kept in this news those miners that are likely to be producers before 2020.

This month we have seen some bold forecasts (from Mike Beck), continued very strong lithium demand, and rapid progress towards production from Altura Mining (OTCPK:ALTAF), Pilbara Minerals (OTCPK:PILBF) and Tawana Resources.

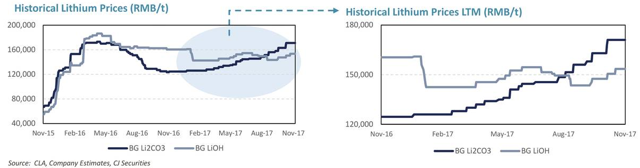

Lithium spot and contract price news

During November, 99.5% lithium carbonate China spot prices were unchanged for the month. According to the Galaxy November presentation, China net lithium carbonate prices are at USD 20,500/tonne. SQM reported contract prices for lithium carbonate "surpassing US$13,000/ton."

On November 21 at the Hard Asset Conference, Mike Beck stated he sees lithium prices going much higher "probably on its way to US$100,000/tonne" as you can view in his video here (12.20 minute mark), "Mike Beck: Nickel, Cobalt, and Lithium to Benefit From Generational Demand Shift in Commodities." Wow!

China Lithium spot price chart 2015 to 2017